Choosing the Right Business Structure in the UAE

Selecting the right UAE business structure types appears to be the most critical decision required by any investor or entrepreneur globally. Selecting your preferred structure will determine your business operation tax obligation ownership rights long term scalability and visa eligibility.

There are options in the UAE that create flexibility alongside complexity such as free zone, mainland or Offshore entities based on your business.

- Overview of UAE business structure types

- UAE business structure types – Mainland features and company suitability

- UAE business structure types – Freezone benefits and limitations

- UAE business structure types – Offshore company purpose and cases

- Key factors comparison for choosing right UAE business structure types

- Conclusion

- FAQs

- Q1. Which UAE business structure is ideal for local trading?

- Q2. Is it possible for free zone companies to operate in the mainland?

- Q3. Are offshore companies ideal for active business in the UAE?

- Q4. Do all UAE companies pay corporate tax?

- Q5. Is it possible for a business to change its structure later in the UAE?

Overview of UAE business structure types

In the UAE, there are three primary business structure types that are Mainland, offshore and free zone companies. Which of these regions are regulated by different specific authorities, designed for particular commercial activities. Mainland companies are licensed under the Department of Economy and Tourism (DET) in every Emirate.

On the other hand freezone companies are monitored by specific freezone authorities. Moreover offshore companies are a typical utility for asset holding and global businesses. The specific utilities and business structure types support investors to align their business goals with legal business formation.

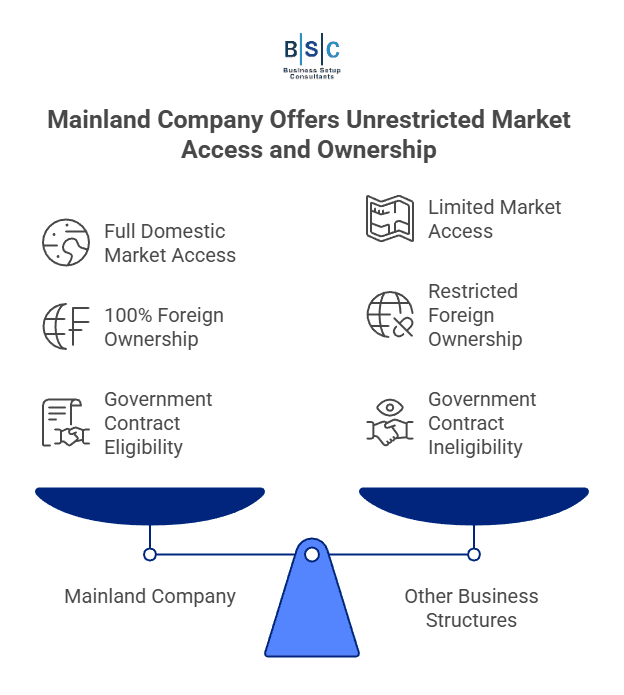

UAE business structure types – Mainland features and company suitability

Are you looking for government contracts and access to the domestic market in the UAE? The mainland company is suitable for trading across all 7 Emirates without geographical limits but directly serving the government entities, businesses and UAE consumers.

All credits to the commercial company’s law reforms through which UAE have now embraced 100% foreign ownership in most of the sectors that bring a major shift attracting Global investors.

As per 2026 updates, around 250,000 new companies totaling up to 1.4 million active entities emerged in the mainland UAE business environment.

| Metric | Recent updates |

| Active companies in the UAE mainland | 1.4 million companies active by the end of 2025. |

| New added companies in 2025 | 250,000 new entities. |

| Ownership | 100% foreign ownership. |

| Accessibility | Full access to the domestic market and government tenders in the UAE. |

| Licensing authority | DET |

UAE business structure types – Freezone benefits and limitations

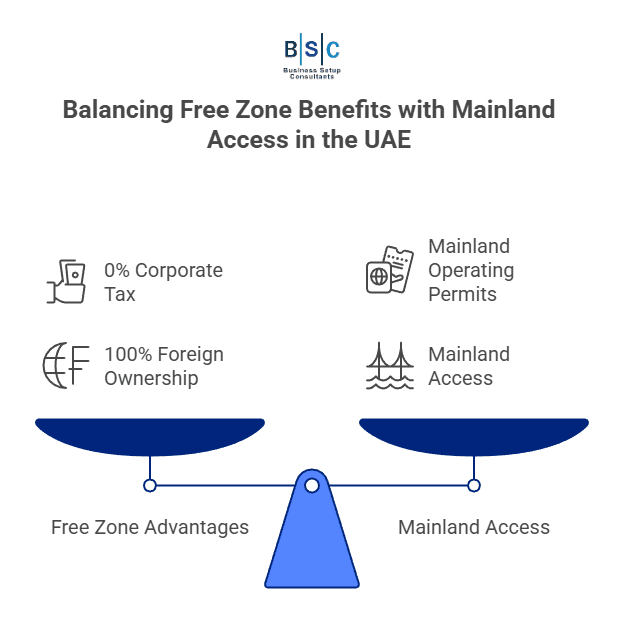

Another UAE business structure type is found in the free zone which is known as the powerhouse of business formation specific for technology firms, export-import and SME Ventures.

In 2026 nationwide free zones have reached the count of 45+ with tax free incentives on qualifying income which is most attractive for the Global entrepreneurs.

According to the survey, Dubai alone hosted 112,000 freezone licenses that represented half of the entire UAE freezone registration. The policy reforms are now allowing companies in the free zone to operate even in the mainland with effective permits.

Readers also prefer to read about starting a business in the UAE 2026.

| Metric | Recent updates |

| Active companies in the UAE free zones | 45+ free zones |

| Freezone companies in 2026 | 150,000+ companies |

| Dubai free zone licenses | 112,000+ in Dubai |

| Ownership | 100% foreign ownership |

| Tax incentives | 0% corporate tax |

| Mainland access | Now possible via Mainland Operating Permits (2026) |

UAE business structure types – Offshore company purpose and cases

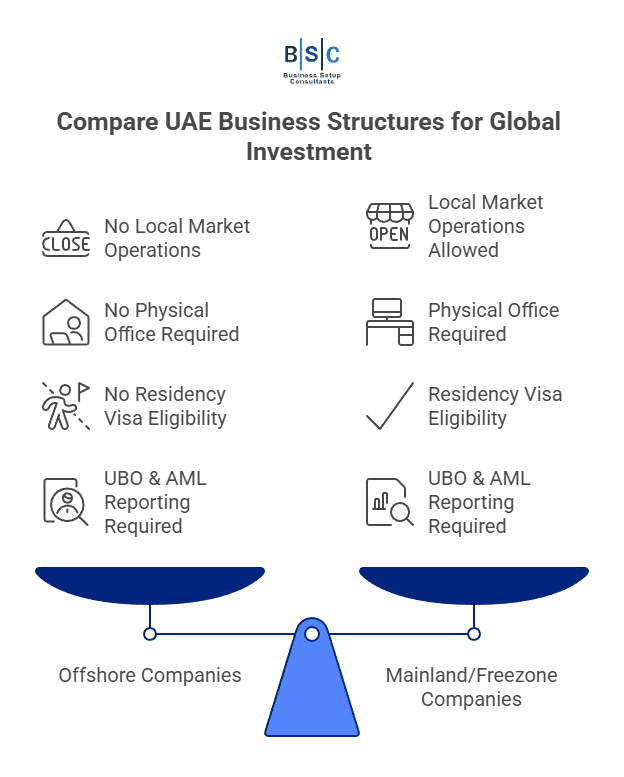

Offshore companies UAE are also another UAE business structure types personalized for IP ownership, holding structures, international investment and Asset Management.

These entities provide cost efficiency, confidentiality and simplicity, though they cannot operate in the UAE market like mainland and freezone businesses.

With recent regulatory transformation there is limited flexibility delivered to the licenced offshore activities. Offshore business setup is best for wealth structuring and global investment holding instead of service delivery or local sales.

Also read about offshore companies in detail.

| Metric | Recent updates |

| Active companies in the UAE offshore | Share ownership, investments and asset holdings. |

| Local operations | No permission unless special approval is granted. |

| Office requirement | No physical office required. |

| Visa eligibility | Offshore entities typically do not qualify for UAE Residency visas. |

| Compliance | UBO & AML reporting required. |

| Market demand | Steady demand for holding vehicles and investment globally. |

Key factors comparison for choosing right UAE business structure types

Still, there are confusions regarding decision making for UAE business structure types.

Here are the key factors required to consider for making the right selection of UAE business structure types based on your business activities.

| Key factors | Mainland | Free zone | Offshore |

| Business activity | Ideal for professional and commercial activities. | Approval limited to freezone. | Not permitted to trade in the UAE. |

| Target market | UAE local and international clients. | Primarily global markets. | International holdings only. |

| Visa availability | Flexible visa. | Limited visa package. | No visa eligibility. |

| Banking & compliance | Strict compliance and high bank acceptance. | Moderate Bank acceptance. | Strict due diligence and limited banking. |

| Tax exposure | UAE corporate tax | 0% tax on qualifying income. | No UAE operational tax. |

| Scalability | High scalability within UAE. | Moderate scalability. | Not designed for growth. |

| Exit & Conversion | Easy restructuring or conversion. | Possible with approval. | Limited conversion options. |

How about a free zone to mainland transition? 👈Check this out!

Conclusion

Selecting the right UAE business structure types is a legal formality and also it boosts the strategic foundation for your business activity. Mainland companies are ideal for businesses emphasized on the local market and government contracts.

On the other hand, freezone companies provide efficiency and flexibility for global operations. Moreover, offshore entities deliver investment purposes and specialised holding.

With careful evaluation of compliance obligations, market accessibility and business activity along with growth plans, you can easily structure your business regulating immediate operations and long-term success. So, what are you waiting for?

Let’s connect with us to make the right decision.

FAQs

Q1. Which UAE business structure is ideal for local trading?

Mainland companies are ideal for unrestricted trading in the UAE market.

Q2. Is it possible for free zone companies to operate in the mainland?

Yes, with dual license or mainland operating permit free zone can operate in the mainland.

Q3. Are offshore companies ideal for active business in the UAE?

No, offshore companies are not good for active business but effective for international activities and asset holding.

Q4. Do all UAE companies pay corporate tax?

Only taxable profits above AED 375,000 are subject to UAE corporate tax.

Q5. Is it possible for a business to change its structure later in the UAE?

Yes, obviously a business can change its structure under regulatory approval and restructuring procedures.