Limited Liability Company Formation in Dubai: A Complete Guide [UPDATED]

Limited Liability Company Formation in Dubai is all about starting flexible and scaling strategically. Entrepreneurs mostly select LLC in Dubai because it carries the potential to minimise the gap between incorporated entities and informal businesses.

LLC’s provide incorporation benefits like credibility and liability protection without the need of excessive administrative burden. As companies’ scalar some of the LLC’s transform into corporations for attracting institutional investors for global expansion.

In 2025 the regulatory Framework in Dubai permitted smooth restructuring that makes LLCs future ready at the very starting point.

- Liability and tax advantages regarding Limited Liability Company formation in Dubai

- Acknowledging LLC vs Corporation: Limited Liability Company formation in Dubai

- Incorporated vs Unincorporated: Business Setup Company in Dubai

- Key benefits regarding Limited Liability Company formation in Dubai

- LLC vs. Corporation: Making the Right Choice

- LLC Incorporated vs. Unincorporated: Which is better?

- Unlocking the Benefits of LLC Company Formation

- LLC Company Formation in Dubai: A Strategic Move

- Key Steps in LLC Company Formation

- Business Activity Selection:

- Partnering with Business Setup Consultants DMCC:

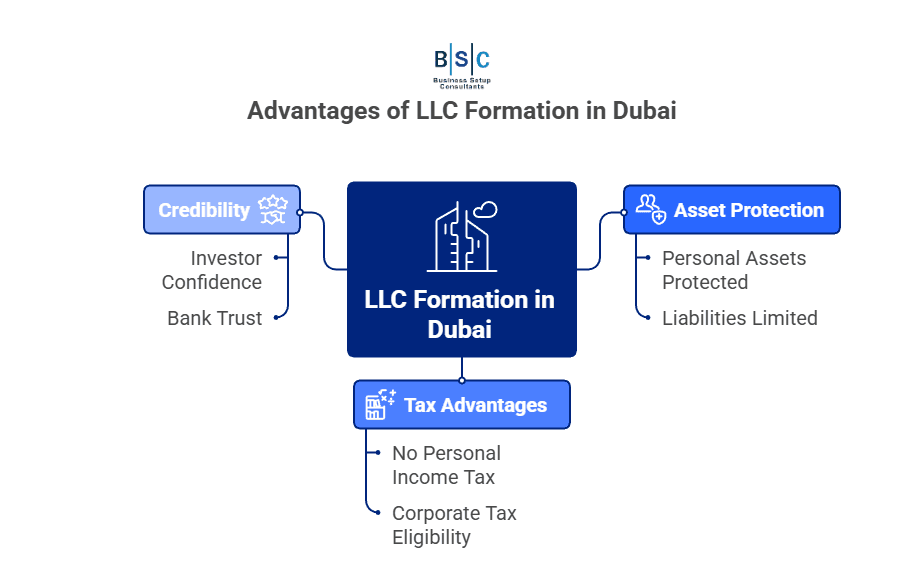

Liability and tax advantages regarding Limited Liability Company formation in Dubai

Limited liability company formation in Dubai offers scalability, tax optimization and asset protection.

Here are your advantages with LLCs

- Personal assets remain protected under LLC.

- Liabilities limited to share capital contribution.

- No personal income tax in the UAE.

- Eligibility for compliance and VAT registration.

- Strong credibility for investors and banks.

- 9% corporate tax for profits above AED 375,000.

Also read about business licensing in Dubai.

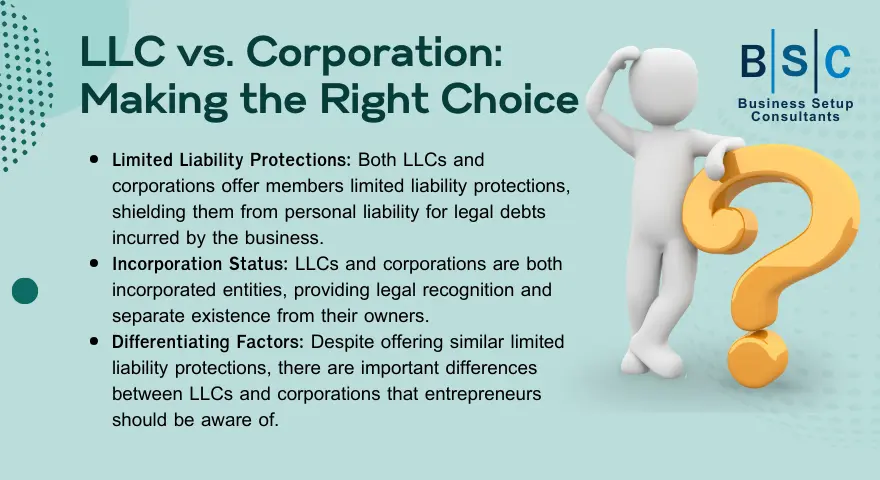

Acknowledging LLC vs Corporation: Limited Liability Company formation in Dubai

Business Setup Company in Dubai LLC offers similar protection like corporations but comes with different complexity.

Here is a quick breakdown for you

Aspect | LLC | Corporation |

Legal liability | Limited | Limited |

Compliance burden | Low | High |

Governance | Flexible | Board & shareholders required |

Annual meetings | Not mandatory | Mandatory |

Tax structure | Simpler | More complex |

Best for | SMEs & startups | Large enterprises |

Incorporated vs Unincorporated: Business Setup Company in Dubai

Limited liability company formation in Dubai comes with the last longing registered business plan. You must learn about Incorporated and unincorporated aspects.

Aspect | Incorporated (LLC) | Unincorporated |

Legal identity | Separate legal entity. | No separate identity. |

Asset protection | Yes | No |

Credibility | High | Limited |

Banking access | Easy | Difficult |

Scalability | High | Restricted |

Risk exposure | Limited | Unlimited |

Readers also prefer to learn about FZ vs Mainland licensing opportunities.

Key benefits regarding Limited Liability Company formation in Dubai

Do you know? Business Setup Company in Dubai LLC is dominating the business landscape. Here it is why —

- Protection of personal assets.

- Flexible ownership.

- Strong market credibility.

- Easier banking accessibility.

- Mainland operational compatibility.

Dubai has attracted around USD 30 billion FDI annually where LLC remains a preferred structure for investors expecting scalability and stability in the UAE.

Steps to establish Limited Liability Company: Business Setup Company in Dubai

In order to avoid the costly delay, you must follow these steps to get your limited liability company formation in Dubai.

Step | Description |

Business activity selection | At first opt for approved activity with your business objectives. |

Legal structure finalization | Single or multiple shareholders. |

Trade name registration | Unique trade name and secure compliance. |

Initial approval | Get DED or authority approval. |

Office setup | Physical or approved virtual office. |

MOA Drafting | Properly defined ownership and roles. |

Legal issuance | Professional and commercial license issued. |

LLC vs. Corporation: Making the Right Choice

Both LLCs and corporations provide members with limited liability protections for their supervisors as they are all incorporated. For legal debts, they do not have any personal concern with it. Nevertheless, these are different factors that are very important to know.

Cost requirement for Limited Liability Company formation in Dubai

Knowing the cost before committing Limited Liability Company formation in Dubai is your financial smartness.

Here is a quick breakdown

Cost component | Est range (AED) |

● Trade license | 10,000 – 25,000 |

● Trade name and approvals | 1,000 to 3,000 |

● MOA & Legal drafting | 2,000 to 5,000 |

● Office & Ejari | 5,000 to 20,000 |

● Visa per person | 3,500 to 6,000 |

● Total estimate | 20,000 to 50,000+ |

LLC Incorporated vs. Unincorporated: Which is better?

Many entrepreneurs choose this when it comes to starting a business. Form a Limited Liability Company Formation in Dubai because of its flexibility and simplicity. However, whenever businesses find the growing process difficult they find that converting their LLC to a corporation is a more appropriate option. An LLC can be incorporated simply by changing the structure from an LLC to a corporation.

Unlocking the Benefits of LLC Company Formation

Forming an LLC offers entrepreneurs a blend of flexibility, liability protection, and operational ease. As the preferred choice for many businesses, an LLC shields its owners from personal liability while providing tax advantages and simplified management structures. For the growth of business, this step provides a suitable environment as well.

LLC Company Formation in Dubai: A Strategic Move

Dubai with its strategic location robust infrastructure and investor–friendly policies emerge as a prime destination for Limited Liability Company Formation. The emirate’s dynamic business ecosystem, coupled with its strategic global positioning, offers unparalleled opportunities for entrepreneurs aiming to establish their presence in the Middle East and beyond.

Key Steps in LLC Company Formation

Navigating the process of LLC Company Formation involves several crucial steps:

Business Activity Selection:

The first step is to choose the right business activity for LLC company Formation. From trading to manufacturing Dubai offers a wide range of activities. In this regard, consideration is very important to understand to set the business goals and fulfill the market demand.

Legal Structuring:

The most important thing is to select the most appropriate legal structure. Regulatory requirements are important whether it is a single member of an LLC or multiple LLC share-holder. Clearly understanding the deep-rooted compliances efficiently is very important.

Trade Name Registration:

For the identification of a brand giving a secure and unique name is very important. Checking the name and necessary documents is very crucial during the registration process of a trade name.

Physical or Virtual Office Setup:

Constructing an office physical or online presence is very important for LLC Company Formation in Dubai. The physical office gives you more palpability while the virtual office provides more flexibility and reliability. Making the right decision depends upon your business.

Licensing and Permitting:

The crucial aspect of LLC Company Formation is getting the required licenses. Depends on the needs of commercial, professional, or industrial licenses. Handling the process of licensing process efficiently gives you the ensurity compliance and seamless operation.

Partnering with Business Setup Consultants DMCC:

Navigating the intricacies of LLC Company Formation in Dubai requires expert guidance and support. Business Setup Consultants DMCC stands as your trusted partner in this journey and offers comprehensive services tailored to your business needs. From initial consultation to license acquisition and beyond our expert team ensures a smooth and hassle–free setup process.

Conclusion

It’s finally acknowledged that Limited Liability Company setup in Dubai is all about building a smart, protected and growing global economy in 2025-2026.

LLC in Dubai provides a proper combination of modern business credibility and flexibility with protection that enhance business performance with low taxation, global accessibility and legal safeguarding.

In order to make LLC your Dubai opportunity in 2026, let’s connect with us to get a start to end support.

FAQs

Q1. What is the minimum shareholder count required for LLC formation in Dubai?

One or more shareholders is enough for formation of an LLC in Dubai depending on the business activity.

Q2. Does LLC provide 100% foreign ownership in Dubai?

100% foreign ownership is allowed for Mainland business activities in Dubai.

Q3. What is the corporate tax applicable limit for LLC in Dubai?

With your taxable profit exceeding AED 375,000 then 9% corporate tax is applied.

Q4. Do you need a physical office mandatory for LLC in Dubai?

Yes, a registered office address or Ejari is important to get mainland LLC formation in Dubai.

Q5. How long will it take for LLC formation in Dubai?

Around 5 to 10 working days are required for LLC formation in Dubai with approval and documentation.