Abu Dhabi Development Holding Company Setup

An Abu Dhabi development holding company offers some compelling advantages to onshore and Free Zone businesses. This blog post will explain the setup process for both structures within this dynamic economic center in the United Arab Emirates. Below, we’ll cover licensing, tax benefits, asset protection, credit access, and the supportive business environment it offers.

- Types of Holding Companies in Abu Dhabi

- Why Open a Holding Company in Abu Dhabi?

- How to Open a Holding Company in Abu Dhabi

- Setup Cost of a Abu Dhabi Development Holding Company Setup

- Let Us Guide You

- FAQs

- What are the primary types of holding companies that can be established in Abu Dhabi?

- What are the key steps involved in setting up an onshore holding company in Abu Dhabi?

- What advantages do Free Zone holding companies in Abu Dhabi offer to international investors?

- Why should I consider opening a holding company in Abu Dhabi?

- What steps are involved in opening a holding company in Abu Dhabi, and how does the process vary for onshore and Free Zone structures?

- What is the cost associated with establishing a holding company in Abu Dhabi?

- What are the estimated expenses for setting up a holding company in Abu Dhabi?

- How can Business Setup Consultants DMCC assist in establishing an Abu Dhabi development holding company?

Types of Holding Companies in Abu Dhabi

In Abu Dhabi, entrepreneurs can set up two primary types of holding companies: onshore and Free Zone.

Onshore Holding Companies in Abu Dhabi

Abu Dhabi allows investors to set up holding companies onshore as Limited Liability Companies or Public Joint Stock Companies (PJSCs). At least two shareholders must own them and abide by Abu Dhabi’s laws regarding commercial corporations.

Onshore holding companies are subject to local regulations in Abu Dhabi, with registration with the Department of Economic Development (DED). Following registration with DED comes an official business license, which must be obtained before commencing operations; additional permits may also be needed depending on what your specific company entails.

Free Zone Holding Companies in Abu Dhabi

A free zone is a designated area within the UAE that operates with its own set of business-friendly regulations. These zones are designed to attract foreign investment and stimulate economic activity.

Abu Dhabi has strategically established several free zones to offer this favorable business environment, for example, Abu Dhabi Global Market (ADGM). These zones provide a compelling range of benefits for International holding company Abu Dhabi, including generous tax exemptions such as 0% corporate tax on profits, 100% foreign ownership for complete control over your investments, flexibility with no currency restrictions, and the ability to repatriate 100% of your profits back to your home country.

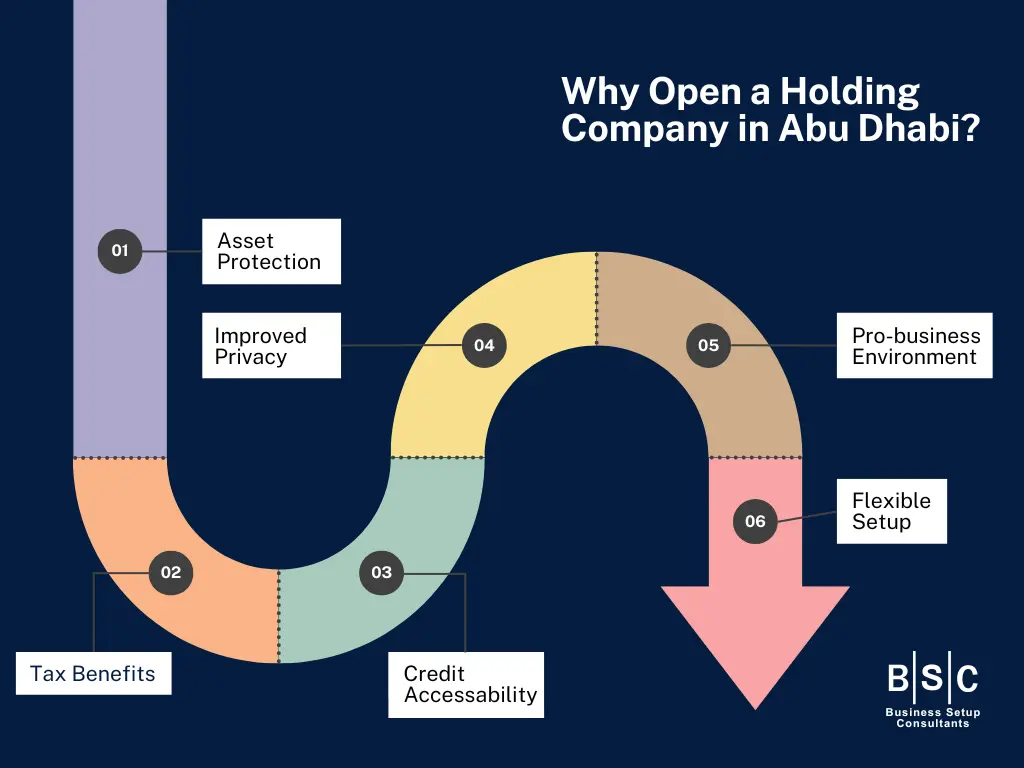

Why Open a Holding Company in Abu Dhabi?

Setting up a holding company in Abu Dhabi, offers investors a compelling range of benefits. Here are some of the main ones:

- Asset Protection: Your holding company can protect your assets. The liabilities of one subsidiary won’t threaten the other assets while preserving your investments.

- Tax Benefits: Abu Dhabi’s tax system is favorable and can dramatically reduce your tax burden, mainly when you use Free Zone structures.

- Credit Accessability: Credit is now easier to obtain for your holding firm since lenders look at the financial strength of your subsidiaries. This will allow you to access funds to expand and grow.

- Pro-business Environment: Abu Dhabi actively supports companies, providing incentives such as tax exemptions and encouraging an efficient regulatory environment.

- Flexible Setup: No minimum capital requirements and various corporate structures (LLC or joint stock company or free zone, etc.) allow you to set up your holding company flexibly to your particular requirements.

- Improved Privacy: The Abu Dhabi regulatory environment protects your holding company and its subsidiary companies more than direct ownership structures.

How to Open a Holding Company in Abu Dhabi

Establishing a holding company in Abu Dhabi requires careful planning and several steps. The process will slightly differ depending on your chosen structure (onshore or Free Zone) and location. Here’s a general roadmap:

- Select your holding firm type: Select between onshore (operating in Abu Dhabi, ideal for the local market) as well as Free Zones (established in free zones designated with tax- and other benefits).

- Pick your location: If you are onshore, sign up in the Abu Dubai’s Department of Economic Development (DED). Think about which area in the emirate is best suited to your requirements.

- Choose a business name: Make sure it’s in use and conforms to DED standards.

- Prepare essential documentation: Includes the Memorandum as well as articles of Association, business plan as well as shareholder agreements, identification proof, etc.

- Get permits and licenses: You must obtain the appropriate permits required by the activities of your holding company. The relevant authorities could include the DED or free zone authorities.

- Open a corporate bank account: You can choose a banking institution that is located in Abu Dhabi and provide the required documents for opening an account in your business’s name.

- Apply for a registration and a trade license: Sign up officially through the DED (or the authority for free zones) and get your license to trade.

Setup Cost of a Abu Dhabi Development Holding Company Setup

Establishing a holding company in Abu Dhabi involves multiple expenses. Here’s an outline of these:

Essential Fees:

- Initial Approval: AED 120

- Trade Name Registration: AED 600

- License Application: AED 600

Potential Additional Costs

- Business Center Rent: AED 25,000 (approximate annual cost can vary across Abu Dhabi)

- Free Zone Licensing: Starts at around AED 15,000 (depending on the chosen free zone within Abu Dhabi)

- Legal & Business Consultation: Fees vary based on the provider and services needed in Abu Dhabi

- Memorandum of Association Drafting: Costs depend on the complexity and legal assistance used within Abu Dhabi

Important Considerations:

- These are estimated costs and can fluctuate based on your chosen free zone (if applicable), specific business activities, and the level of professional support you utilize within Abu Dhabi.

- It’s wise to budget at least AED 20,000 or more to cover the setup process in Abu Dhabi comfortably.

Let Us Guide You

An Abu Dhabi development holding company provides a strategic option to control and protect your investment assets. This can provide advantages such as the reduction of the tax burden, fewer risk of financial losses, increased flexibility, and the capacity to diversify your portfolio. Although setting up can be managed, ensuring you have the accuracy and quality of your documents is vital to ensure a pleasant journey.That’s where Business Setup Consultants DMCC comes in. Our expert team specializes in company creation across Abu Dhabi and the wider UAE. We’ll help you navigate all the steps, ensuring you have an efficient and seamless creation of your holding business. Contact us now to find out how we can ease your process of establishing an effective holding company with us.

FAQs

What are the primary types of holding companies that can be established in Abu Dhabi?

Entrepreneurs in Abu Dhabi can set up either onshore holding companies, such as Limited Liability Companies or Public Joint Stock Companies, or Free Zone holding companies.

What are the key steps involved in setting up an onshore holding company in Abu Dhabi?

Onshore holding companies need to be registered with the Department of Economic Development (DED), and the process involves obtaining an official business license and any additional permits required for specific business activities.

What advantages do Free Zone holding companies in Abu Dhabi offer to international investors?

Free Zone holding companies, like those in Abu Dhabi Global Market (ADGM), provide benefits such as 0% corporate tax on profits, 100% foreign ownership, currency flexibility, and the ability to repatriate 100% of profits to the investor’s home country.

Why should I consider opening a holding company in Abu Dhabi?

Opening a holding company in Abu Dhabi offers advantages such as asset protection, favorable tax systems, improved access to credit, a pro-business environment with incentives, flexible setup options, and enhanced privacy compared to direct ownership structures.

What steps are involved in opening a holding company in Abu Dhabi, and how does the process vary for onshore and Free Zone structures?

The general roadmap includes selecting the company type, choosing a location, deciding on a business name, preparing essential documentation, obtaining permits and licenses, opening a corporate bank account, and applying for registration and a trade license. The process may vary based on the chosen structure (onshore or Free Zone).

What is the cost associated with establishing a holding company in Abu Dhabi?

The setup cost includes essential fees such as initial approval, trade name registration, and license application, along with potential additional costs like business center rent, Free Zone licensing fees, legal and business consultation fees, and costs related to drafting the Memorandum of Association.

What are the estimated expenses for setting up a holding company in Abu Dhabi?

Estimated costs can vary based on factors such as the chosen free zone, specific business activities, and professional support levels. It is advisable to budget at least AED 20,000 or more to cover the setup process comfortably.

How can Business Setup Consultants DMCC assist in establishing an Abu Dhabi development holding company?

Business Setup Consultants DMCC specializes in company creation in Abu Dhabi and the UAE, providing expert guidance through the entire process. Their team ensures accuracy and quality in document preparation, making the establishment of a holding company efficient and seamless. Contact them for assistance in establishing an effective holding company.